Subscribers to FutureFirst™, Good Judgment’s exclusive forecasting and monitoring service, enjoy 24/7 access to expert-driven insights on key economic, geopolitical, and market-moving questions. Superforecast Alerts, included with the service, provide timely updates when:

Related questions are grouped into clusters to offer broader analytical context. See our discussion on the relevance-rigor trade-off for more details.

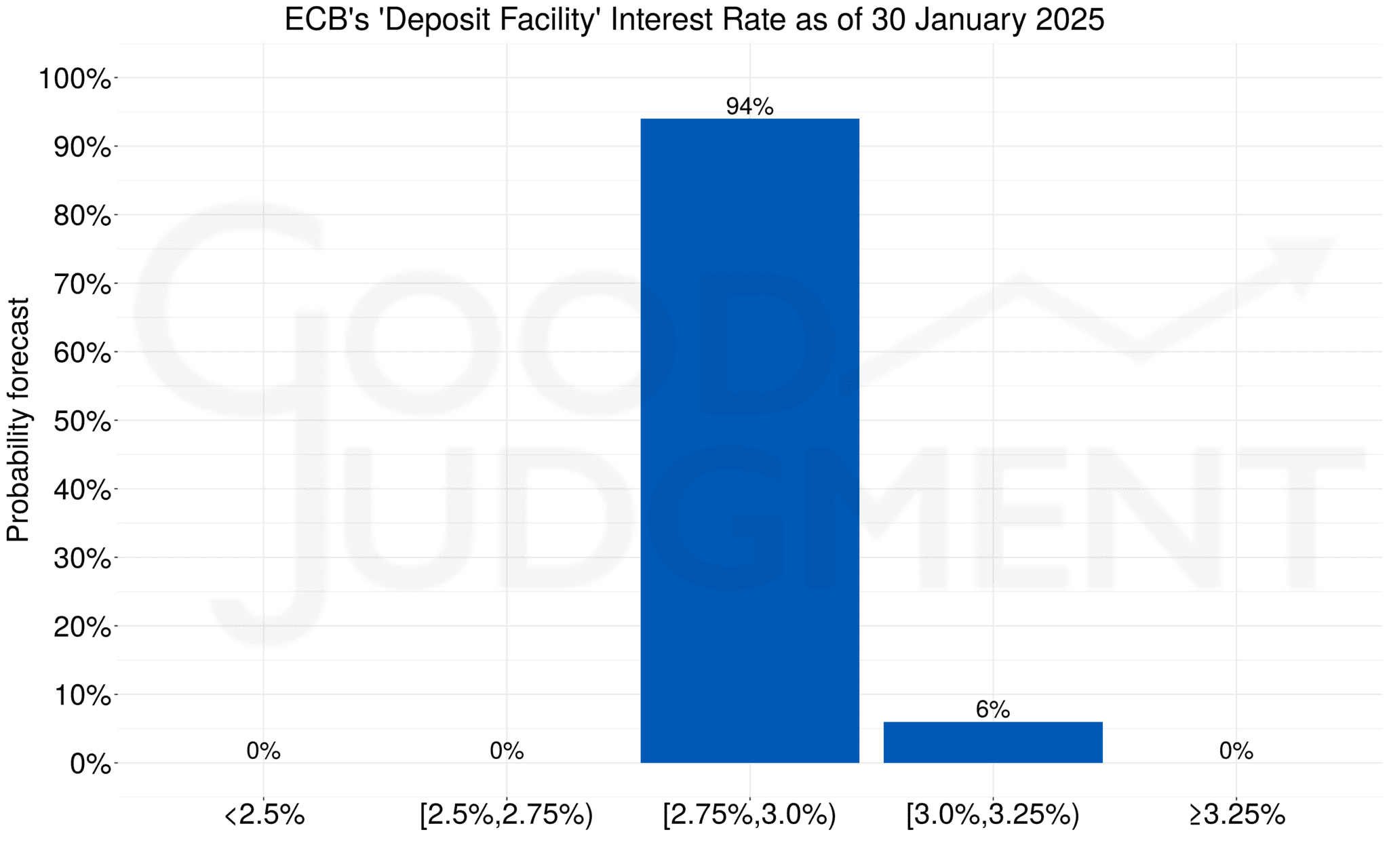

These alerts give clients timely, usable insights provided by Good Judgment’s elite Superforecasters, a diverse global team with a proven track record of accuracy. Here’s an example available to FutureFirst subscribers on 18 January 2025. This alert focused on expected interest rate decisions from the European Central Bank (ECB) and the Bank of England (BoE).

| Date | Less than 2.50% | At least 2.50%, but less than 2.75% | At least 2.75%, but less than 3.00% | At least 3.00%, but less than 3.25% | 3.25% or higher |

|---|---|---|---|---|---|

| 18 Jan 2025 | 0% | 0% | 94% | 6% | 0% |

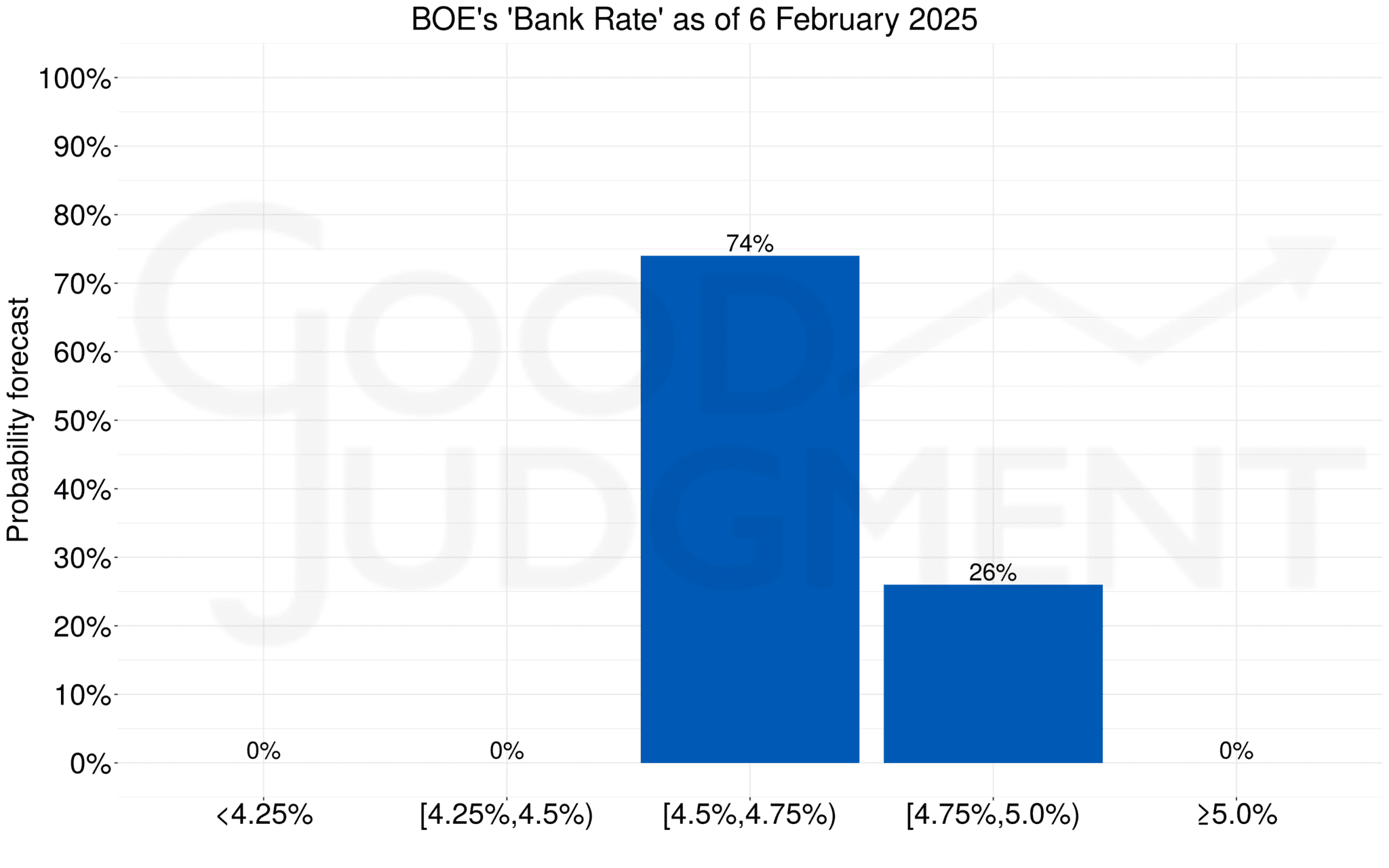

| Date | Less than 4.25% | At least 4.25%, but less than 4.50% | At least 4.50%, but less than 4.75% | At least 4.75%, but less than 5.00% | 5.00% or more |

| 18 Jan 2025 | 0% | 0% | 74% | 26% | 0% |

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts.

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts.

Looking ahead to the Bank of England’s meeting on 6 February 2025, Superforecasters see a 74% probability that the Bank Rate will decrease to at least 4.50% but less than 4.75%, with a 26% probability for it to stay the same at a range of at least 4.75% but less than 5.00%. A recent dip in UK inflation to 2.5% has strengthened expectations for a rate cut, as economists see evidence of the restrictive monetary policy’s effectiveness in easing inflation pressures. However, ongoing concerns about inflationary pressures driven by the government’s tax measures and rising gilt yields may complicate the central bank’s easing strategies. Despite these uncertainties, most surveyed economists anticipate a quarter-point cut in the upcoming meeting.

Superforecaster Quotes

Superforecaster Quotes

Superforecaster Sources

Superforecast Alerts like this give our clients a decisive advantage by providing early warnings and Superforecasters’ interpretations of emerging trends. Whether you’re monitoring central bank decisions, geopolitical events, or financial markets, FutureFirst keeps you informed, so you can make better decisions sooner.

📩 Want to receive exclusive alerts like this? Subscribe to FutureFirst today.

Schedule a consultation to learn how our FutureFirst monitoring tool, custom Superforecasts, and training services can help your organization make better decisions.