Finance is all about forecasting. The investor with the earliest insight into future returns reaps the biggest rewards.

The stakes are even higher for Sovereign Wealth Funds. They invest a country’s current assets to generate returns that will help future generations prosper. Here’s how today’s best forecasting practices help a Fund secure a better tomorrow for its citizens.

Industry: Financial Services

Location: Global

Size: >$100 billion in assets

About: This Sovereign Wealth Fund is a global long-term investor in a broad range of private and public asset classes.

All we do is forecasting. We take a view about a company or an asset and decide to invest money on its based on a forecast of the asset cash flow generation in the future. Improving our forecast capacity tends to materially improve our performance.

– Manager at Sovereign Wealth Fund

Design a program to teach best-practice forecasting techniques to analysts in departments ranging from Private Equity to Real Estate.

Take an evidence-based approach to the Fund's talent-development project, using the same tools and techniques that helped the Good Judgment Project win the largest-ever geopolitical forecasting competition.

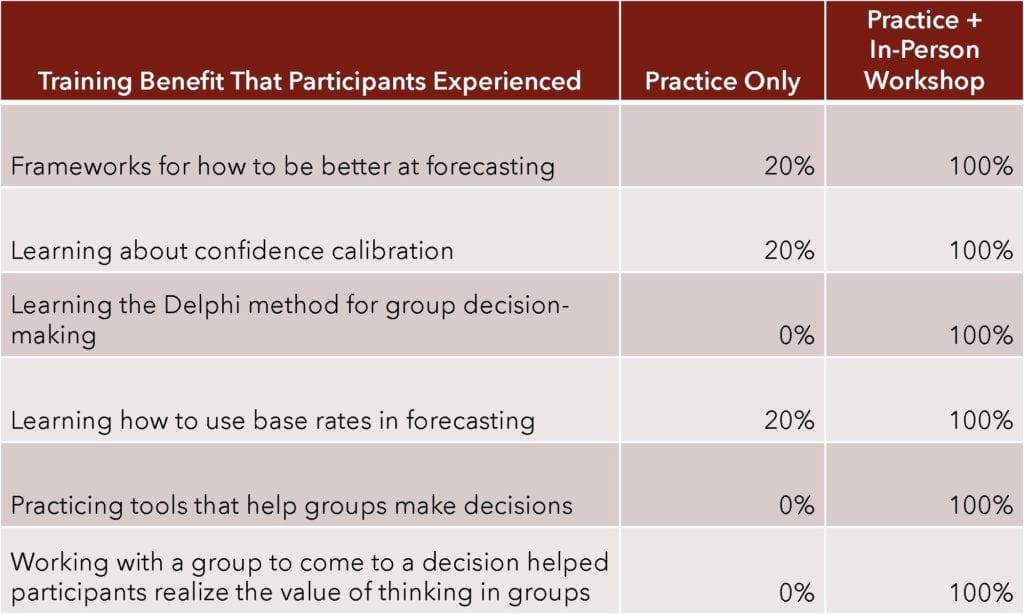

Set up a controlled experiment with three levels of training (no training, online training only, or in-person workshop), and combine each approach with forecasting practice on Good Judgment Open.

Participants who attended an in-person workshop in addition to practice forecasting achieved training objectives far more often than did analysts who received no formal training.

“[Good Judgment] help[ed] us understand people’s biases and see the distribution of views to better check and inform the average [forecast].”

Project ParticipantSchedule a consultation to learn how our FutureFirst monitoring tool, custom Superforecasts, and training services can help your organization make better decisions.