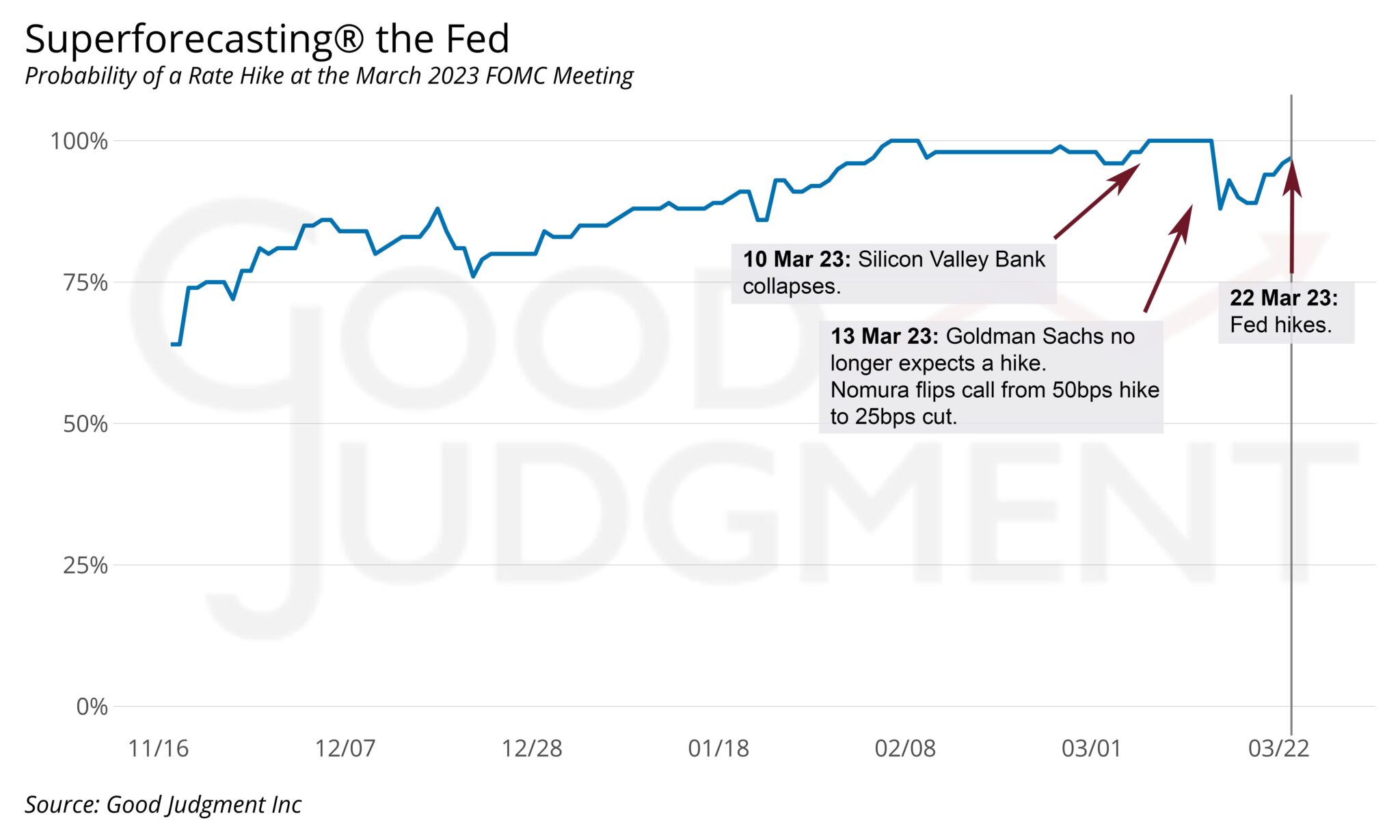

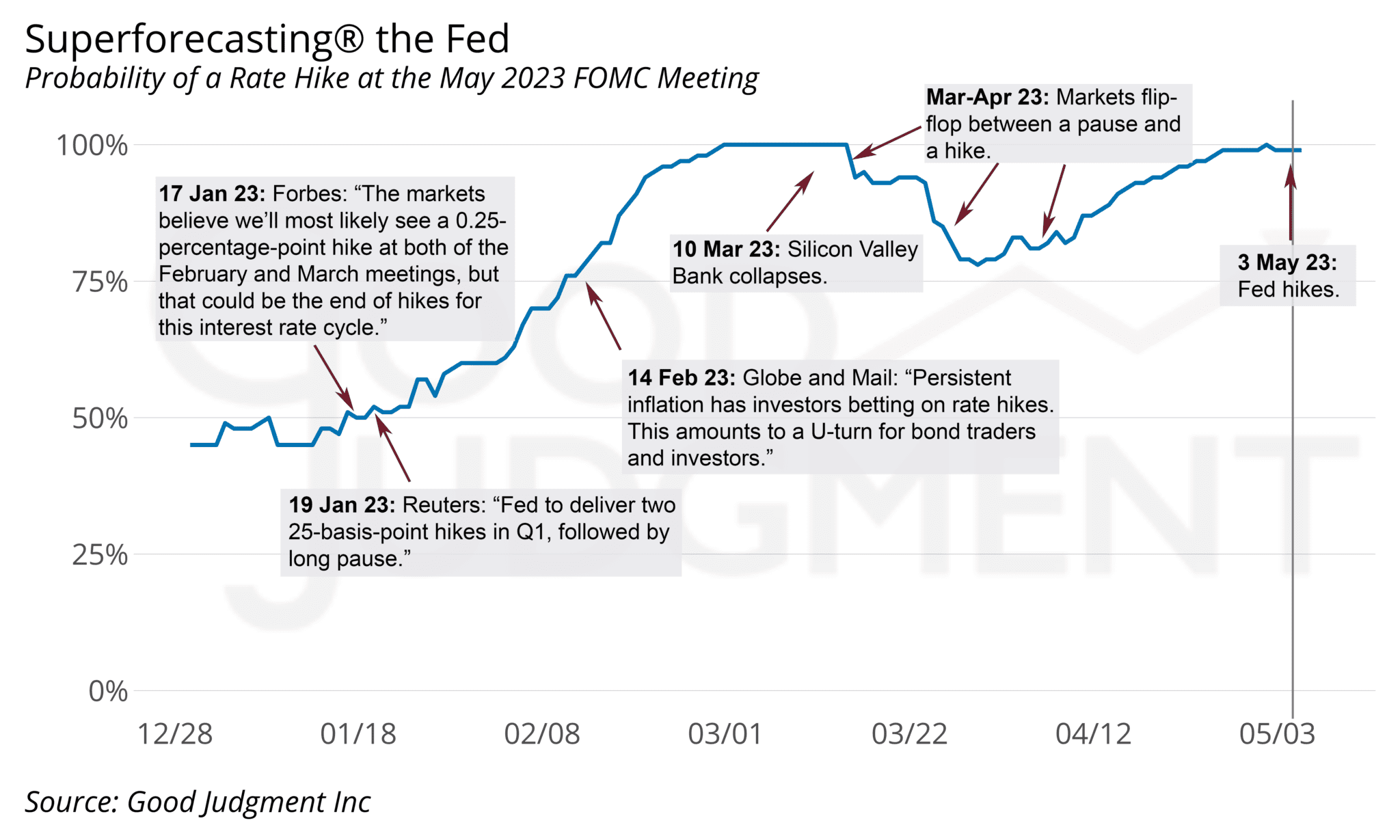

The Federal Reserve’s target range for the federal funds rate is the single most important driver in financial markets. Anticipating inflection points in the Fed’s policy has immense value, and Good Judgment’s Superforecasters have been beating the futures markets this year, signaling the Fed would continue to hike until the June pause while markets and experts alike flipflopped on their calls.

When comparing the forecasts of two groups—Good Judgment’s Superforecasters and the futures markets using the CME FedWatch Tool—for the last four Federal Reserve meetings, the Superforecasters assigned higher probabilities to the correct outcome. They were 66% more accurate than the futures (as measured by Brier scores) and had lower noise in their forecasts (as measured by standard deviation).

See our new whitepaper for details. We also provide subscribers with a full summary of all our active Fed forecasts, which is updated before and after each meeting (available on request).

Good Judgment’s Superforecasters have been providing a clear signal on the Fed’s policy well before the futures and many market participants. Subscribers to FutureFirst™ have 24/7 access to evolving forecasts by the Superforecasters on questions that matter, including Fed policy through the rest of the year and beyond, along with a rich cross-section of other questions crowd-sourced directly from users, including questions on Ukraine, China, and the upcoming US elections.

Schedule a consultation to learn how our FutureFirst monitoring tool, custom Superforecasts, and training services can help your organization make better decisions.