Already subscribed to FutureFirst? Log in here.

FutureFirst™, Good Judgment’s exclusive monitoring tool, gives 24/7 access to timely insights and commentary on top-of-mind questions from a diverse global team of professional Superforecasters.

FutureFirst combines the advantages of an expert network with model-friendly quantitative forecasts of likely outcomes of uncertain events.

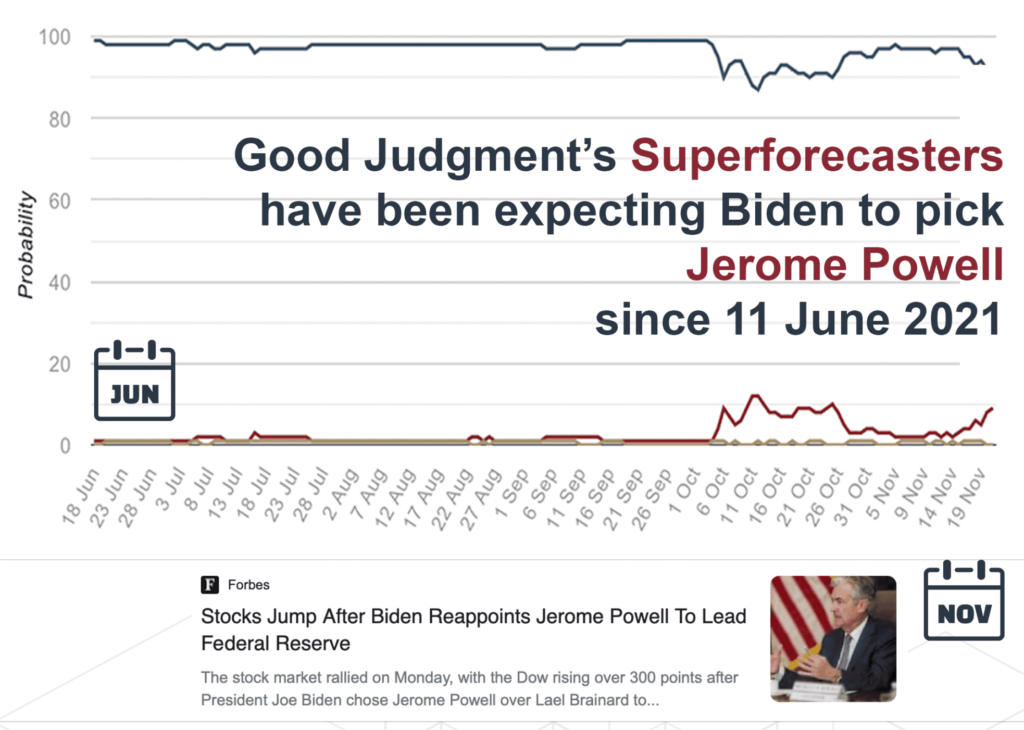

Daily forecast updates from our subscription service allow clients to spot emerging risks earlier, while Superforecaster® commentary and research enable them to red-team their own analyses and to understand the “why” behind the results in a way that is impossible with machine-generated forecasts.

A subscription to FutureFirst provides:

Questions are grouped by theme or topical focus, and current channels include Geopolitics, Economics, China, Ukraine, and the Federal Reserve. Subscribers can also track topics that matter most to them on a tailored watchlist.

Superforecasting® US Politics features Superforecasters’ take on the future of US policy and other top-of-mind questions concerning the direction the global powerhouse will take under the new administration.

Superforecasting® Ukraine is a dashboard of key questions about the future of the conflict in Ukraine and its implications. This topical dashboard is a subset of the FutureFirst™ dashboard and is available for a limited time.

“Team Good Judgment, led by Philip Tetlock and Barbara Mellers of the University of Pennsylvania, beat the control group by more than 50%. This is the largest improvement in judgmental forecasting accuracy observed in the literature.”

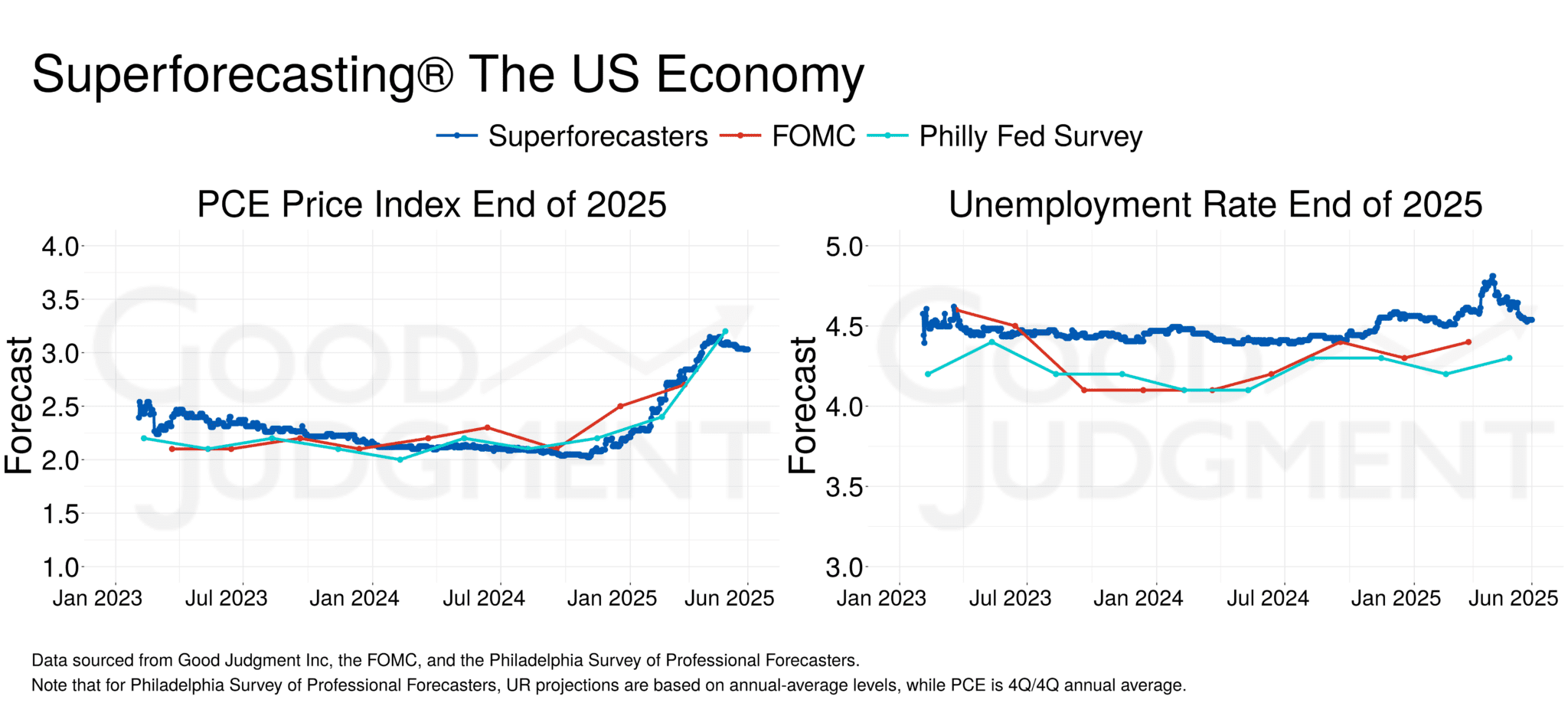

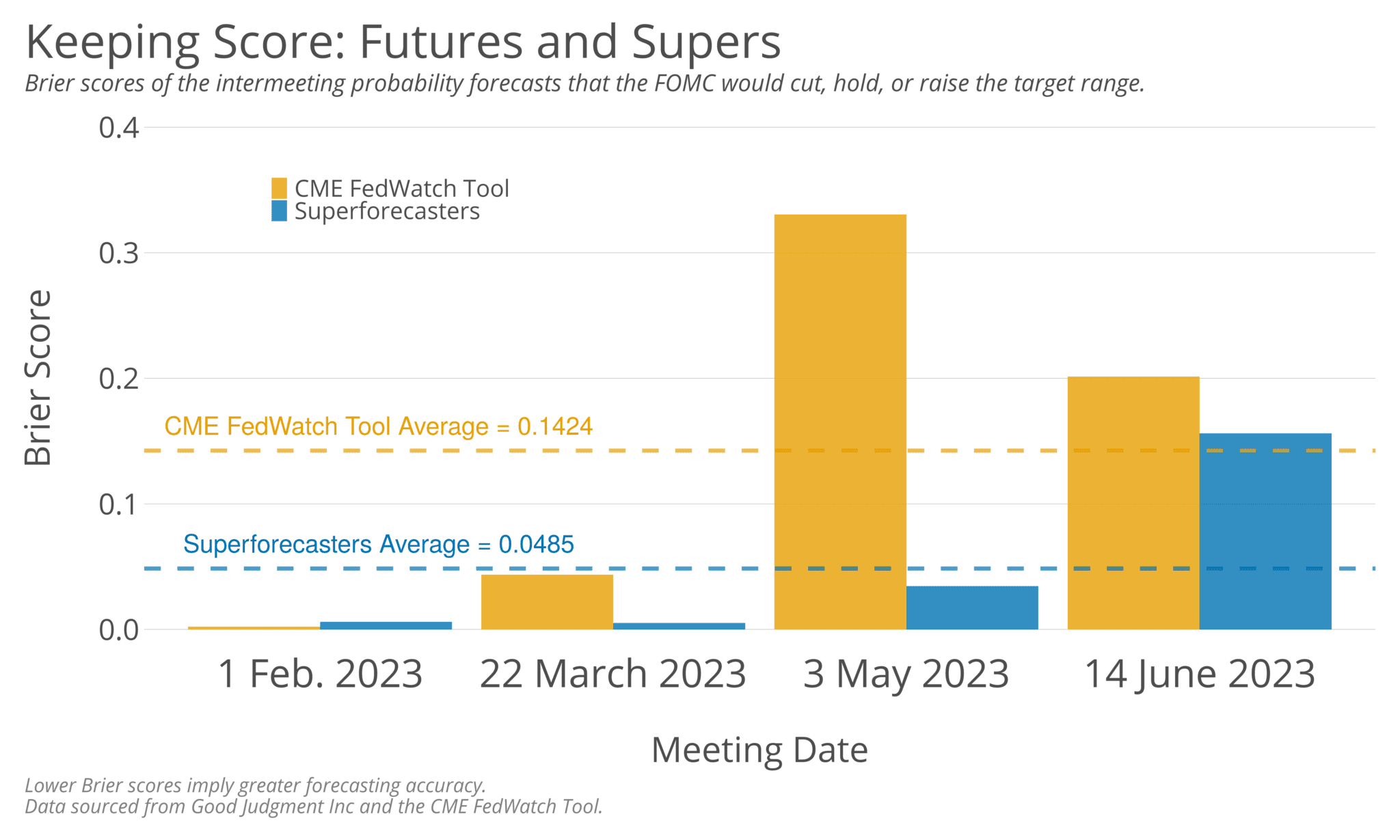

Steven Rieber, Program Manager, IARPANYT’s Peter Coy writes, “Fed watchers on Wall Street have had a bad past few months. […] Good Judgment Inc., a private forecasting outfit, calculates that its […] superforecasters […] were more accurate in two respects: closer to the mark and with less variability. That’s captured in their Brier score, in which zero is perfect accuracy. The superforecasters’ Brier score over the past four Fed meetings was 0.05, while that of forecasters included in the widely consulted CME FedWatch Tool was 0.14.”

An independent analysis by the MAN Institute revealed that investors who follow our COVID-19 vaccine availability forecasts could have anticipated a 5% downturn in the market for a basket of COVID-sensitive stocks with more than two weeks’ advance warning. Their conclusion: “If there is one thing better than the wisdom of the crowds, it is the wisdom of well-informed crowds.” The Superforecasters are that crowd.

An analysis of Good Judgment Project forecasts by UC-Irvine decision scientist Mark Steyvers found that Superforecasters anticipated events 400 days in advance as accurately as regular forecasters could see those events 150 days ahead.

| ☑ | Unrivaled accuracy on the future |

| ☑ | Precise probability values with context |

| ☑ | Cutting-edge crowd-sourcing tools |

| ☑ | Early indicators to take action sooner |

Schedule a consultation to learn how our FutureFirst monitoring tool, custom Superforecasts, and training services can help your organization make better decisions.