Four Steps to Integrate Probabilities into Decisions

Decision makers often want a simple “yes” or “no.” This creates a challenge when you’re in the business of providing probabilities. If you tell them there’s a 76% chance of Event X happening by Date Y, you might get this response: “So that’s a yes!” When you point out the remaining 24% chance it won’t happen, you might get: “So that’s a no?”

Busy leaders need to get straight to action. They often simplify the process by treating anything above 50% as a “yes” and anything below as a “no.” However, it’s rarely the case that the yes/no boundary is 50% in the real world. The true yes/no boundary, which we call the decision threshold, depends on the nature of the decision, the cost, and the stakes involved.

Say there’s a 28% chance of rain. For a casual picnic, you might accept the risk and go anyway. But for an outdoor wedding reception, your threshold for action is probably much lower. You may set up tents just in case.

The decision threshold is fundamentally about cost-benefit analysis: How many false positives are you willing to accept in order to avoid missing a real threat or opportunity?

For example, if you risk losing $100 and the cost of mitigation is $35, it may be worth taking action (mitigating the risk) if the probability of loss exceeds 35%.

The Four-Step Framework

Instead of simply delivering a forecast for the decision maker to interpret, we reverse the process by defining the yes/no boundary first. Here’s our four-step process for decision makers to use forecasts with clear thresholds, leading to better, faster judgments.

1. Identify the core decision. Begin by clearly stating the decision the organization faces. Here are a few examples:

- Committing to an innovation cycle to mitigate the risk of a future regulatory ban on a key product.

- Preparing for a possible increase in US tariffs on a critical base metal import.

- Validating the underlying assumptions of a new investment thesis before allocating capital.

2. Set the decision threshold. The yes/no boundary can only be set by the decision maker. Will they act at 20%? 40%? 60%? By focusing on the cost and stakes, they avoid defaulting to the simple (and often misguided) 50% threshold.

3. Pose the question to the forecasters. Ideally, they should be unaware of the specific decision or the decision maker’s identity. This firewall ensures the probability estimate remains independent and unbiased. But if anonymity can’t be provided, treat the forecasting as a separate process as much as possible. Remember: Forecasts focus on how the world will be while decisions often reflect what we want the world to be.

4. Deliver the actionable forecast. With the yes/no boundary already in place, the decision maker can use the probability estimate immediately to make a call. With this robust framework, decision makers are able to use probabilities effectively to arrive at better decisions faster.

Learn more about FutureFirst and see ahead of the crowd.

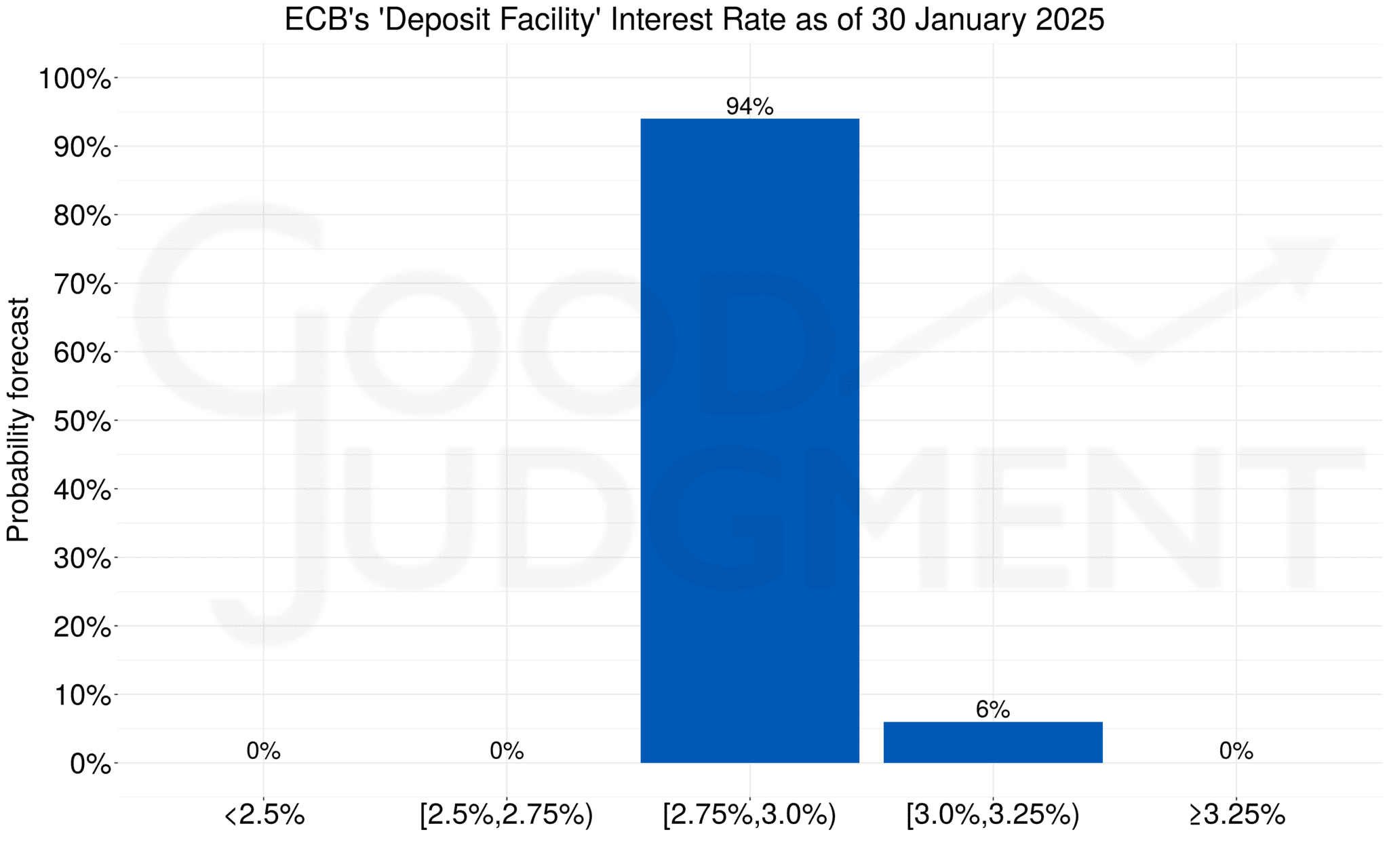

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts.

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts. Superforecaster Quotes

Superforecaster Quotes