Superforecasters Beat Futures Markets for a Third Year in a Row

Sure enough, the Fed cut rates again in December. Good Judgment’s Superforecasters had generally expected this outcome since the question was launched in October. They trimmed their odds briefly following conflicting statements from Fed officials, a situation compounded by the lack of data on how the economy fared during the shutdown. They later raised their confidence once again that there would be another cut.

Sure enough, the Fed cut rates again in December. Good Judgment’s Superforecasters had generally expected this outcome since the question was launched in October. They trimmed their odds briefly following conflicting statements from Fed officials, a situation compounded by the lack of data on how the economy fared during the shutdown. They later raised their confidence once again that there would be another cut.

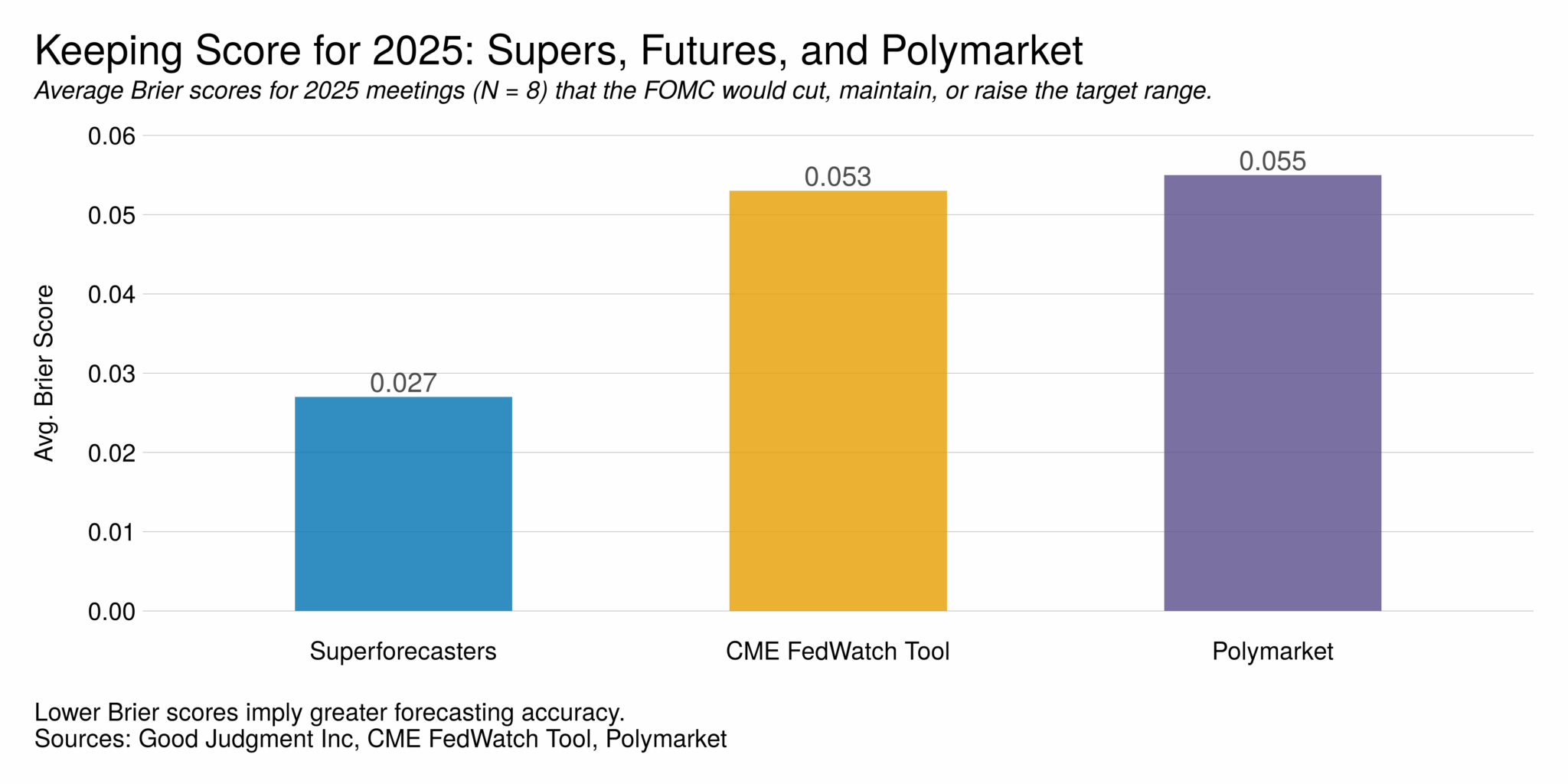

Looking at the Brier scores (lower is better) for the Superforecasters and CME’s FedWatch for 2025 as a whole, Good Judgment emerges as nearly twice as accurate as the futures markets.

This time, we have added Polymarket to our analysis. The data shows the prediction market simply tracked CME pricing, volatility and all, adding little to no value for decision-makers.

Bottom line: The Superforecasters have shown less noise, reflecting genuine uncertainty in their forecasts when it was warranted, and they have now beaten CME’s FedWatch for the third year in a row.

Keep up with the latest Superforecasts with a FutureFirst subscription.