What if there’s no Blue Wave?

Over the week before the election, Good Judgment’s professional Superforecasters engaged in an extensive “pre-mortem” or “what-if” exercise regarding our forecasts for a Blue-Wave election. We asked the Superforecasters to imagine that they could time-travel to a future in which the 2020 election results are final, with the Republicans retaining both the White House and control of the Senate. Then, we asked them to “explain” why the outcomes differed from the most likely outcomes in their pre-election probabilistic forecasts. Thinking through these scenarios now, before the actual outcomes are known, helps to avoid hindsight bias (the tendency to view what actually happened as being more inevitable than it was).

Over the week before the election, Good Judgment’s professional Superforecasters engaged in an extensive “pre-mortem” or “what-if” exercise regarding our forecasts for a Blue-Wave election. We asked the Superforecasters to imagine that they could time-travel to a future in which the 2020 election results are final, with the Republicans retaining both the White House and control of the Senate. Then, we asked them to “explain” why the outcomes differed from the most likely outcomes in their pre-election probabilistic forecasts. Thinking through these scenarios now, before the actual outcomes are known, helps to avoid hindsight bias (the tendency to view what actually happened as being more inevitable than it was).

If we had asked the same questions six months earlier, the Superforecasters would have responded differently because there would have been many more uncertainties still in play. In April, we didn’t know whether progressives would fully back the Democratic ticket. We didn’t know that former Vice President Biden would choose Senator Kamala Harris as his running mate. We certainly didn’t know how the COVID pandemic and its economic and social fallout would evolve. And, the possibilities of an “October surprise” were wide open.

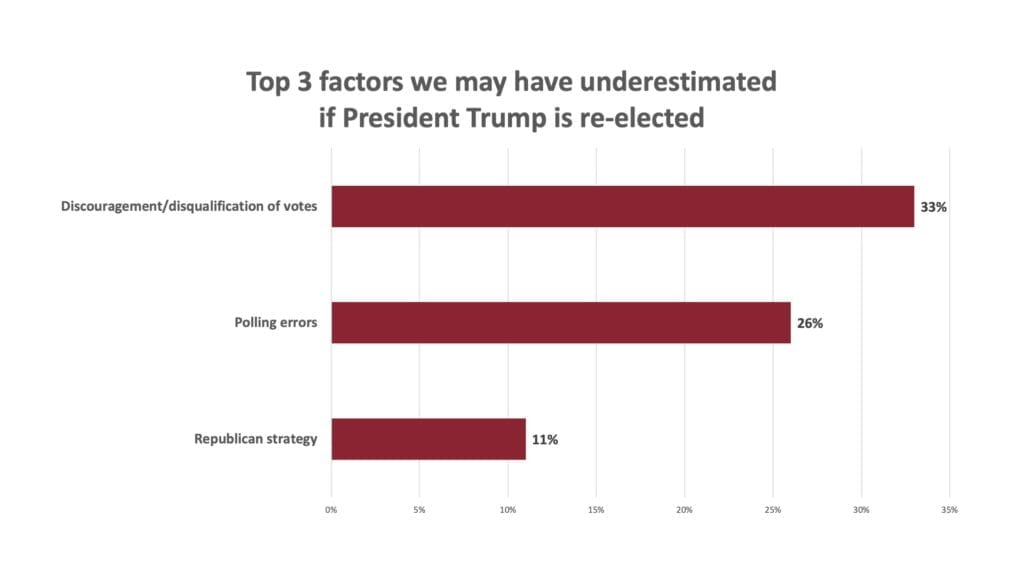

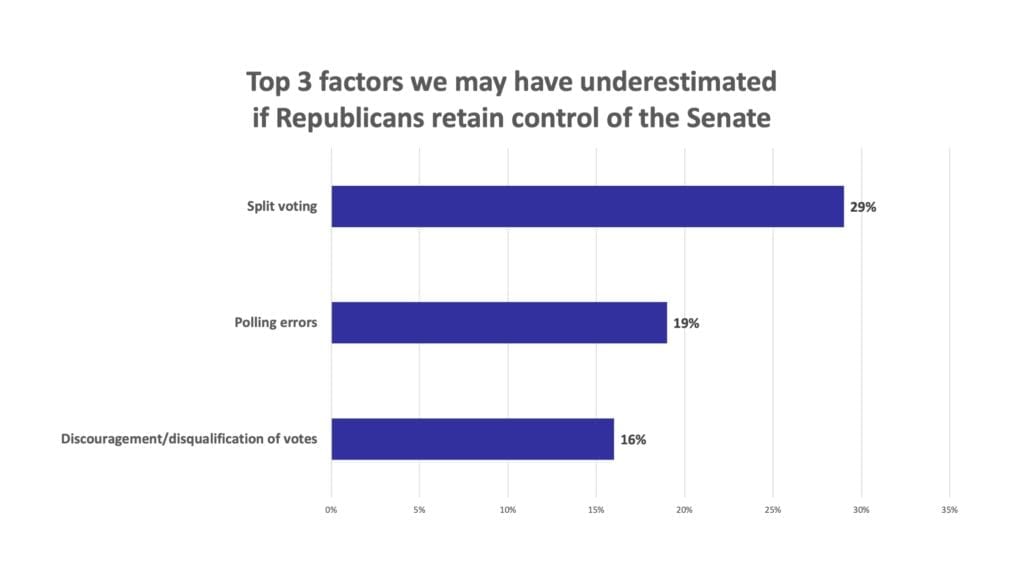

Our what-if exercise unsurprisingly focused on the factors that remained most uncertain a week before Election Day. For each election question (Presidency and control of Senate), the factors Superforecasters most frequently cited for the “wrong side of maybe” outcomes fell into three categories, summarized in the charts below.

Here’s how the Superforecasters talked about each of the possible explanations for the Presidency and control of the Senate to remain in Republican hands, despite our high probability estimates that the Democrats would prevail in each case.

-

- We underestimated the likelihood that “close races plus voting mechanics complications [would] lead to judicialization of the election result.” (Explanations generally consistent with this commenter’s view received 33% of the upvotes on the Presidential side and 16% of the upvotes on the Senate side.)

We already know quite a bit about early turnout, thanks to great work by people like Michael McDonald of the University of Florida. But we don’t know how many more people will cast votes. And, critically, we don’t know how many ballots will be disqualified because they arrived past the moving goalpost for eligibility or failed to meet some other requirement. Superforecasters expect the opposing camps to litigate these issues wherever the preliminary vote counts are close enough that disputed ballots could change the outcome. If our less-than-20% scenario for the Republicans to retain the White House materializes, many Superforecasters imagine that “a much-larger-than-expected percentage of mail-in ballots were rejected in the battleground states.”

Similarly, if the Republicans hold the Senate, Superforecasters anticipate that “optimization of Republican control of important election processes in key Senate battleground states: ballot collection processes, court decisions, restrictions on voter eligibility, etc.” will have played an important role. As with the Presidential race, they imagine that “mail-in voting complications [could] lead to undercounting of Democratic votes.” (Like most observers, they expect that Democrats are more likely than Republicans to vote by mail.)

By the way, “judicialization of the election result” does not imply a single Supreme Court decision that determines the outcome of the race. Rather, a host of state and federal court rulings already have affected which votes will count, and Superforecasters expect the courts to become involved in even more such decisions before this election is decided.

-

- We placed too much reliance on “polls that were less accurate than believed, even taking into account the fact that everyone knows they aren’t perfect, leading to people underestimating the chances of the party behind in the polls.” (26% of all upvotes – Presidency; 16% – Senate)

Superforecasters acknowledge that “most of us are influenced by models like 538, The Economist, and others that rely primarily on polls” when forecasting US elections. But we can’t determine exactly how much Good Judgment’s election forecasts rely on a particular poll or polls in general because our Superforecasts combine and weight the probabilities assigned by individual Superforecasters to arrive at a collective estimate of the likelihood of the various outcomes.

Recognizing that the 2016 polls favored a Clinton victory, most Superforecasters have discounted 2020 polls that show extremely high odds of a Biden win. Even so, if President Trump is re-elected and/or the Republicans retain control of the Senate, it is almost definitional that the polls will have been “wrong” in some way.

What polling “errors” do Superforecasters imagine to have occurred in those scenarios? The notion of the “shy Trump voter” was the single most frequently upvoted explanation: “Poll numbers systematically under-counted Republicans, due to either unwillingness to participate in polls or unwillingness to disclose support for Trump.” Other polling-related explanations included “underestimating differences between opinion polls and voter mobilization” and the potential failure of polling-related models such as those of 538 to account for the unique circumstances of holding an election in a pandemic year.

In the case of the Senate, their polling-related explanations tend to see any errors in less stark terms than they envision for the Presidential race. The most upvoted comments in this category included “polls whiffed in the key swing states (a little more than slightly), which brought the race(s) well within the margin of error” and “GOP overperforms the polls, within the margin of error, in the Sunbelt close races (particularly the runoffs in Georgia in January) and Iowa.”

-

- We underestimated the effectiveness of the Republican election strategy. (11% of all upvotes re the Presidential race)

Superforecasters anticipate that President Trump’s re-election, should it occur, would owe more to the effectiveness of the Republican election strategy than they had credited. The most commonly cited strategic “secret weapon” was the Republican “ground game,” with “door-to-door canvassing” proving to be more potent than expected. They also cited the Trump campaign’s “digital advertising” as a factor that they may have underestimated.

-

- We underestimated the extent of split voting (voting for Biden, but for a Republican Senatorial candidate). (29% of all upvotes on the Senate question)

The Superforecasters already project a lower probability for the Democrats to take back the Senate than they do for a Biden victory. But that’s an apples-and-oranges comparison because only 35 of the 100 Senate seats are up for election in 2020, whereas the entire country is at play for the Presidency.

When imagining that the Republicans retain control of the Senate, Superforecasters most commonly anticipate that our forecasts may have underestimated split, or crossover, voting. They see two aspects here: first, voters think more positively about some Republican Senatorial candidates than they do about President Trump; and second, some voters are “disillusioned” with the President but want to see the Republicans hold onto the Senate as a check against a Democratic President and House of Representatives.

The Bottom Line

In this “what-if” exercise, Good Judgment asked the Superforecasters to assume for the sake of argument that the Republicans maintain control of both the White House and the Senate. A key goal of this exercise is to nudge forecasters to rethink the reasoning and evidence supporting their forecasts with an eye to adjusting their probability estimates. Yet, even after several days of internal debate, only a few Superforecasters lowered their estimated odds of a Blue-Wave election. Our aggregate forecasts barely moved.

In other words, a week before the election, Good Judgment’s Superforecasters think our current election forecasts are pretty well calibrated. They don’t see the outcomes as locked in by any means, but they are confident that their current levels of confidence are appropriate.

No single forecast is ever right or wrong unless it is expressed in terms of absolute certainty (0% or 100%). If the true probability that President Trump will be re-elected is only 13% (our forecast as of November 1st), he would win the election 13 out of 100 times if we could re-run history repeatedly. That’s why forecasting accuracy is best judged over large numbers of questions.

We’ve looked at the accuracy of our Superforecasts over hundreds of questions and have yet to find any forecasting method that can beat them consistently. The Superforecasters know what they know – and what they don’t know. When it comes to handicapping the odds for geopolitical and economic events, they’re the best bookies around. Lacking a crystal ball, you’d be wise to give their forecasts serious consideration.

Safe But Not Boring (events that are 75% or more likely to happen in 2021)

Safe But Not Boring (events that are 75% or more likely to happen in 2021)![]() Coin Flip (45% – 55% likelihood of happening in 2021)

Coin Flip (45% – 55% likelihood of happening in 2021) Long Shot (5% – 25% likelihood of happening in 2021)

Long Shot (5% – 25% likelihood of happening in 2021)![]() : Vaccine distribution is expected to go well in the US, but regional pockets may refuse to inoculate at very high rates. The UK could complete its vaccination program by May.

: Vaccine distribution is expected to go well in the US, but regional pockets may refuse to inoculate at very high rates. The UK could complete its vaccination program by May.![]() : However, at least one Superforecaster predicts IT system failure in keeping track of inoculations, causing missed targets in the UK.

: However, at least one Superforecaster predicts IT system failure in keeping track of inoculations, causing missed targets in the UK.

![]() : While most Latin American governments are currently saying mass vaccine distribution will not start before 2022, one Superforecaster thinks they are underestimating the odds: “I expect mass campaigns to begin in nearly all of the region’s largest countries by Q3 of 2021.”

: While most Latin American governments are currently saying mass vaccine distribution will not start before 2022, one Superforecaster thinks they are underestimating the odds: “I expect mass campaigns to begin in nearly all of the region’s largest countries by Q3 of 2021.”![]() : Working from home is here to stay, with local public hot desk/office spaces and an increase in a “hybrid” work environment, e.g., gathering for periodic meetings, precluding workers’ need to commute five days a week.

: Working from home is here to stay, with local public hot desk/office spaces and an increase in a “hybrid” work environment, e.g., gathering for periodic meetings, precluding workers’ need to commute five days a week.![]() : This, however, should spell disaster for commercial real estate sector, with one Superforecaster calling it a “slow-motion train wreck.”

: This, however, should spell disaster for commercial real estate sector, with one Superforecaster calling it a “slow-motion train wreck.”![]() : More online learning is in the cards for schools and universities. “My kids’ generation will be the first to never experience snow days,” one Superforecaster writes. “These are now e-learning days.”

: More online learning is in the cards for schools and universities. “My kids’ generation will be the first to never experience snow days,” one Superforecaster writes. “These are now e-learning days.”![]() : In-person, large-scale academic and business conferences may return in the West.

: In-person, large-scale academic and business conferences may return in the West.![]() : Travel could bounce back to 2019 levels, and before the end of the year, majority of airlines may require proof of vaccination as a precondition for international travel.

: Travel could bounce back to 2019 levels, and before the end of the year, majority of airlines may require proof of vaccination as a precondition for international travel.![]() : One Superforecaster gives even odds that Americans will continue to ignore these measures, which would erode the economy into a recession.

: One Superforecaster gives even odds that Americans will continue to ignore these measures, which would erode the economy into a recession.![]() : Another Superforecaster pins hopes on inoculation to enable a rapid recovery in the services sector in the second half of the year and a drop in unemployment under 4%.

: Another Superforecaster pins hopes on inoculation to enable a rapid recovery in the services sector in the second half of the year and a drop in unemployment under 4%.![]() : Fed is expected to keep interest rates near zero, and there should be a major stock market correction (20 pct +) in 2021.

: Fed is expected to keep interest rates near zero, and there should be a major stock market correction (20 pct +) in 2021.![]() : Will inflation in Q3 exceed 2%? It’s a coin flip.

: Will inflation in Q3 exceed 2%? It’s a coin flip.![]() : Meanwhile in the UK, employment and GDP should remain lower than in 2019, and UK car production is expected to drop below the 2019 level.

: Meanwhile in the UK, employment and GDP should remain lower than in 2019, and UK car production is expected to drop below the 2019 level.![]() : At some point during the year, the British pound and euro should trade at 1:1. Another Superforecaster predicts the euro and Chinese yuan should end 2021 stronger versus USD.

: At some point during the year, the British pound and euro should trade at 1:1. Another Superforecaster predicts the euro and Chinese yuan should end 2021 stronger versus USD.

Over the week before the election, Good Judgment’s professional Superforecasters engaged in an extensive “pre-mortem” or “what-if” exercise regarding our forecasts for a Blue-Wave election. We asked the Superforecasters to imagine that they could time-travel to a future in which the 2020 election results are final, with the Republicans retaining both the White House and control of the Senate. Then, we asked them to “explain” why the outcomes differed from the most likely outcomes in their pre-election probabilistic forecasts. Thinking through these scenarios now, before the actual outcomes are known, helps to avoid hindsight bias (the tendency to view what actually happened as being more inevitable than it was).

Over the week before the election, Good Judgment’s professional Superforecasters engaged in an extensive “pre-mortem” or “what-if” exercise regarding our forecasts for a Blue-Wave election. We asked the Superforecasters to imagine that they could time-travel to a future in which the 2020 election results are final, with the Republicans retaining both the White House and control of the Senate. Then, we asked them to “explain” why the outcomes differed from the most likely outcomes in their pre-election probabilistic forecasts. Thinking through these scenarios now, before the actual outcomes are known, helps to avoid hindsight bias (the tendency to view what actually happened as being more inevitable than it was).