How to Combat Overconfidence—One Superforecaster’s Take

Military historian and Superforecaster® Jean-Pierre Beugoms is featured as an exemplar of outstanding thought processes in best-selling author and top Wharton professor Adam Grant’s latest book, Think Again. Below, he shares insights on overconfidence and how it can be avoided by judging the evidence properly.

A high-confidence forecast can be fully justified when the evidence supporting it is strong. When the evidence supporting such a forecast is weak, then we can say the forecaster is being overconfident. We can therefore avoid overconfidence by properly judging whether the evidence is strong or weak.

I have found that people often fall into the trap of making overconfident forecasts when they let their gut or intuition do the forecasting for them and when they dismiss or overlook critical information that contradicts their forecast rationales.

A textbook example of overconfidence might be Peter Funt’s March 29, 2021, column in USA Today entitled, “There’s zero chance Joe Biden will run in 2024.” A zero-probability forecast for a Biden reelection campaign may well be an accurate one, but the evidence he uses in support of his forecast is underwhelming.

First, Funt bases his forecast on out-of-date information. He points to Ryan Lizza’s campaign reporting which cites four people who say a reelection campaign is “inconceivable” to Biden, but he ignores the more recent reporting of The Hill, which notes that those close to Biden assume he will run again.

Second, Funt interprets Biden’s declaration that he sees his presidency as a bridge to the next generation of leaders in only one way. That is, as a promise to serve one term. Biden’s statement is ambiguous, however. There is no reason why his bridge cannot encompass two terms.

Third, Funt dismisses Biden’s response to a reporter’s question asking him whether he will run again. Although Biden answered in the affirmative, Funt argues that Biden has no choice but to say yes because, if he says otherwise, he will immediately become a lame-duck president. The argument certainly makes sense, but is it not possible that Biden also means it?

Fourth, Funt completely neglects the “outside view.” He fails to look at what other ambitious people in high office have done. Had he done so, he would have realized that Biden’s decision to pass on a chance at winning reelection would be a highly unusual move even given his advanced age.

In short, had Funt considered the reporting that contradicted his assumptions, he may well have tempered his forecast. On the other hand, an article entitled “There’s a forty-five percent chance Biden will run in 2024” will not receive as many clicks.

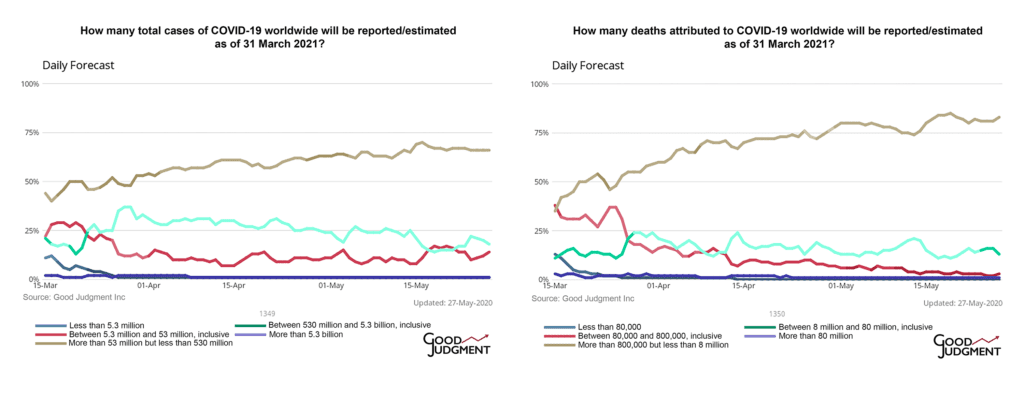

The best way to guard against overconfidence in forecasting is to embrace uncertainty. Most people just want to know whether a fact is true or not and whether an event is going to happen or not. Denied this certainty, they will throw up their hands and declare the future as completely unknowable. This kind of thinking will get you into trouble because reality is often not quite as clear-cut.

You will have to get used to thinking in terms of probabilities of truth instead of yes (100%), no (0%), or who knows (50%). When confronted by a person who thinks in black-and-white terms, do not be afraid to say things like, “yes, but it depends,” or “what you say is true, but I am not as categorical as you are,” or “you are wrong, but not completely wrong.”

As part of your forecast rationale, include a list of uncertainties or possible secondary events that would have an effect on your forecast. Whittle down or expand the list as needed. Try this out and you will be well on your way toward being a well-calibrated forecaster.

Look at your forecasts with fresh eyes from time to time. Play the devil’s advocate and challenge the assumptions that undergird your high-confidence forecast. This exercise will help you weigh more objectively those annoying little facts that call your forecast into question.

Here are some facts that may undermine the high-confidence consensus forecast that the Tokyo Olympics and/or Paralympics will go as planned. While it is true that Tokyo is no longer under a state of emergency, the chances of a renewed surge in cases are not negligible, especially since a good many Japanese would not have received their vaccines by the time the games begin. A clear majority of the Japanese public oppose going ahead with the games, owing to these public health concerns. How would the government of Japan react to a public outcry over another wave of cases? While it is true that the political and economic incentives to hold the games are great, are we to believe that this hypothetical event would have no effect on their decision-making?

I am not arguing that anyone should moderate their near-certain yes forecast (e.g., 95%) to a more tentative yes forecast (e.g., 65%). I am saying that going through this exercise of questioning your own forecast, even if it does not result in you changing your forecast at all, will at least give you greater assurance that your high-confidence forecast is a sound one.