Sneak Peek: How FutureFirst™ Superforecast Alerts Keep You Ahead

Subscribers to FutureFirst™, Good Judgment’s exclusive forecasting and monitoring service, enjoy 24/7 access to expert-driven insights on key economic, geopolitical, and market-moving questions. Superforecast Alerts, included with the service, provide timely updates when:

- A high-profile question is added to the platform.

- The aggregate forecast shifts significantly, signaling a meaningful change in Superforecasters’ expectations.

Related questions are grouped into clusters to offer broader analytical context. See our discussion on the relevance-rigor trade-off for more details.

These alerts empower decision-makers with actionable intelligence provided by Good Judgment’s elite Superforecasters—a diverse global team with a proven track record of accuracy. To illustrate the value of these alerts, here’s an example available to FutureFirst subscribers on 18 January 2025. This alert focused on expected interest rate decisions from the European Central Bank (ECB) and the Bank of England (BoE).

Superforecasting Central Banks

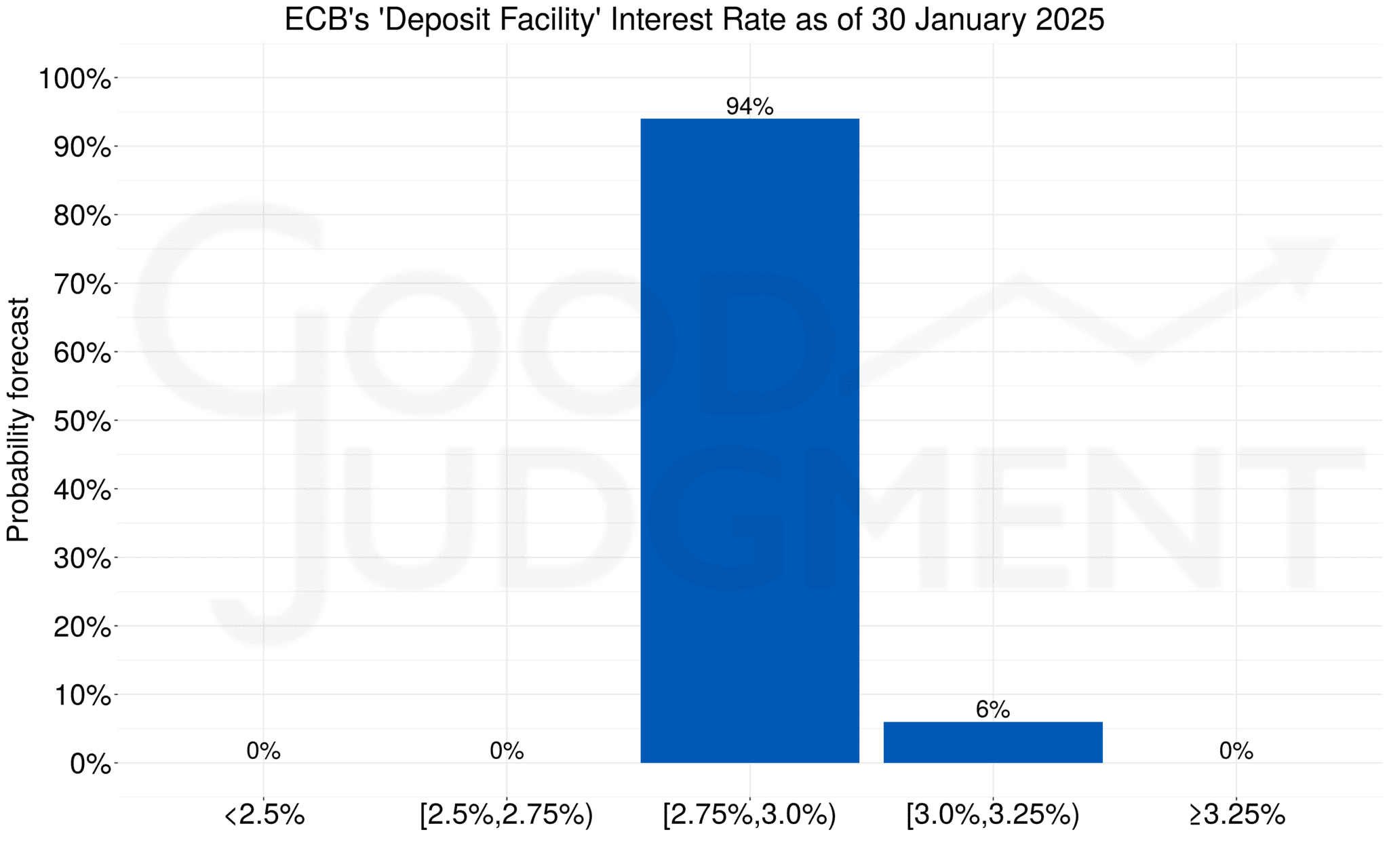

What will be the European Central Bank’s (ECB) most recently announced “Deposit facility” interest rate as of January 30, 2025?

| Date | Less than 2.50% | At least 2.50%, but less than 2.75% | At least 2.75%, but less than 3.00% | At least 3.00%, but less than 3.25% | 3.25% or higher |

|---|---|---|---|---|---|

| 18 Jan 2025 | 0% | 0% | 94% | 6% | 0% |

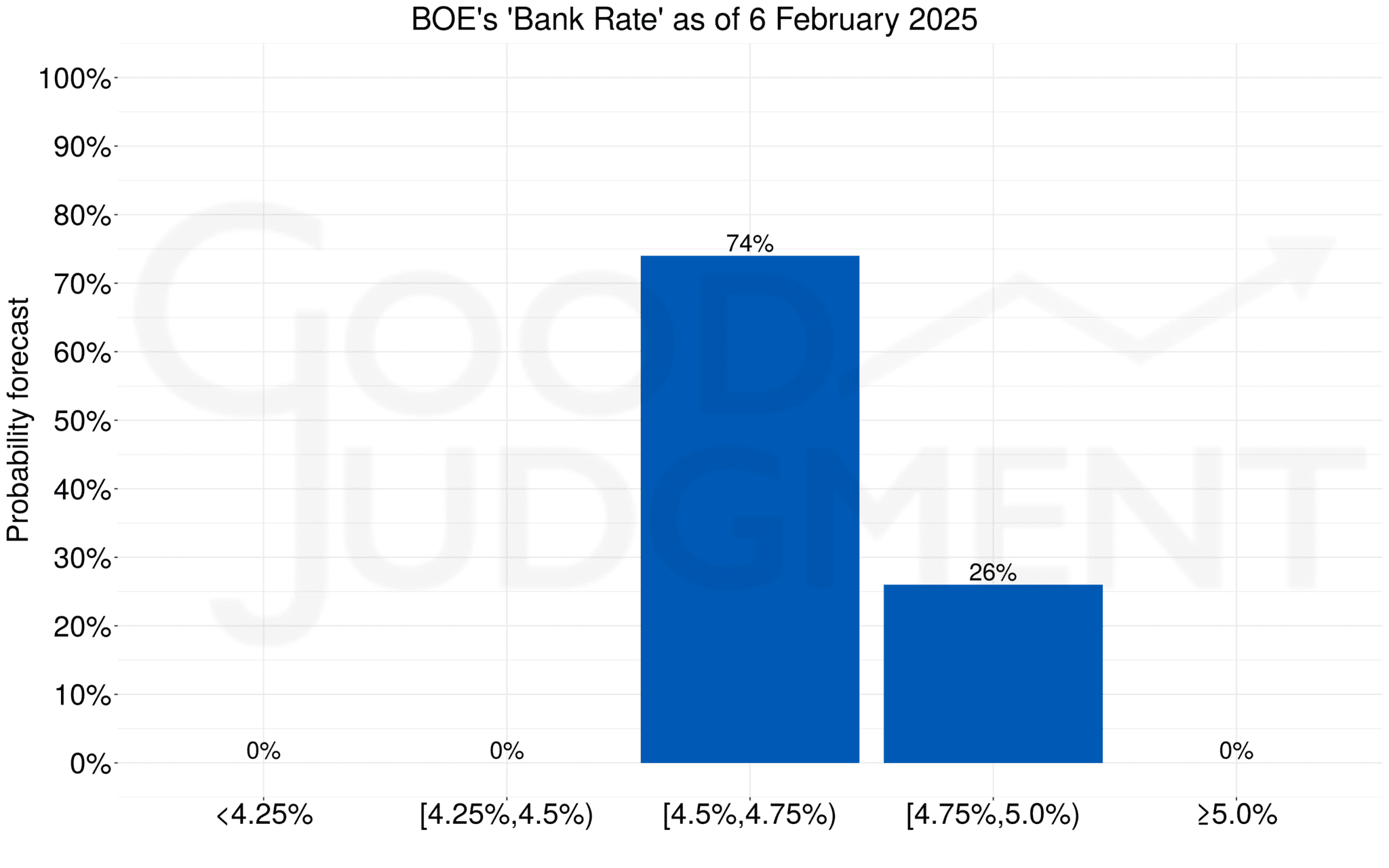

What will be the Bank of England’s Bank Rate at the close of business on February 6, 2025?

| Date | Less than 4.25% | At least 4.25%, but less than 4.50% | At least 4.50%, but less than 4.75% | At least 4.75%, but less than 5.00% | 5.00% or more |

| 18 Jan 2025 | 0% | 0% | 74% | 26% | 0% |

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts.

18 Jan 2025 14:57 ET – To kick off 2025, Superforecasters anticipate the following interest rate decisions. They forecast a 94% probability that the European Central Bank will lower its “Deposit facility” interest rate on 30 January 2025. They expect it to fall within a range of 2.75% to less than 3.00%, with only a minimal chance that the rate will remain the same. Economists in a Reuters survey unanimously expect a 25-basis-point reduction, reflecting the ECB’s ongoing easing cycle amid Europe’s sluggish economic growth and moderately increasing inflation rates, such as a recent 2.4% increase in the eurozone. Despite a gradual rise in inflation, policymakers aim to meet a 2% goal by mid-2025, facing pressures from rising services prices and low unemployment. Yet, concerns about energy costs and inflationary pressures in certain eurozone areas could challenge further rate cuts.

Looking ahead to the Bank of England’s meeting on 6 February 2025, Superforecasters see a 74% probability that the Bank Rate will decrease to at least 4.50% but less than 4.75%, with a 26% probability for it to stay the same at a range of at least 4.75% but less than 5.00%. A recent dip in UK inflation to 2.5% has strengthened expectations for a rate cut, as economists see evidence of the restrictive monetary policy’s effectiveness in easing inflation pressures. However, ongoing concerns about inflationary pressures driven by the government’s tax measures and rising gilt yields may complicate the central bank’s easing strategies. Despite these uncertainties, most surveyed economists anticipate a quarter-point cut in the upcoming meeting.

Superforecaster Quotes

Superforecaster Quotes

- (European Central Bank): “The ECB is two weeks away from what’s widely expected to be the fifth rate cut of this easing cycle. Despite inflation ticking higher last month, policymakers are confident of meeting their 2% goal in 2025 and remain concerned about Europe’s sluggish economy.”

- (European Central Bank): “The European Central Bank can ease policy further this year but must find a middle ground that neither induces a recession nor causes an undue delay in curbing inflation, ECB chief economist Philip Lane told an Austrian newspaper.”

- (European Central Bank): “If interest rates fall too quickly, it will be difficult to bring services inflation under control…But we also don’t want rates to remain too high for too long, because that would weaken the inflation momentum in such a way that the disinflation process would not stop at 2% but inflation could materially fall below target.”

- (Bank of England): “Inflation numbers better than expected, making another cut more likely.”

- (Bank of England): “The deceleration in inflation, which still remains above the BoE 2% target, is likely to be taken by MPC members as a sign that the restrictive monetary policy stance is helping to bring inflation closer to the target. As such, it will give MPC members enough evidence to cut rates by 25bps at their next meeting in February.”

- (Bank of England): “Despite unpredictability around the future policies of US President Elect Donald Trump and their inflationary impact, the economy’s weak momentum might confirm a scenario in which the Bank of England proceeds with faster interest rate cuts in 2025.”

Superforecaster Sources

- Reuters: ECB to cut rates four more times by mid-year, say economists

- MSN: French inflation stays below target as ECB primes next rate cut

- Morningstar: Eurozone Inflation: What to Expect from December’s Data

- Yahoo Finance UK: UK inflation fears spark interest rate cut rethink at Bank of England

- Politico: UK inflation falls in December

- Morningstar: UK Inflation Rate Drops, Boosting Interest Rate Cut Hopes

- Financial Post: Warnings of 3% inflation add to Bank of England’s headache

- Mortgage Strategy: Inflation preview: Higher living costs heap pressure on rate cut hopes

- Bloomberg: ‘Narrower Wiggle Room’ for BoE Rate Cuts, JPM Says

- Trading Economics: United Kingdom Government Bond Yield

Why FutureFirst?

Superforecast Alerts like this give our clients a decisive advantage by providing early warnings and Superforecasters’ interpretations of emerging trends. Whether you’re monitoring central bank decisions, geopolitical events, or financial markets, FutureFirst keeps you informed—so you can make smarter, more confident decisions ahead of the curve.

📩 Want to receive exclusive alerts like this? Subscribe to FutureFirst today.